Posted by Nydia Streets of Streets Law in Florida Divorce

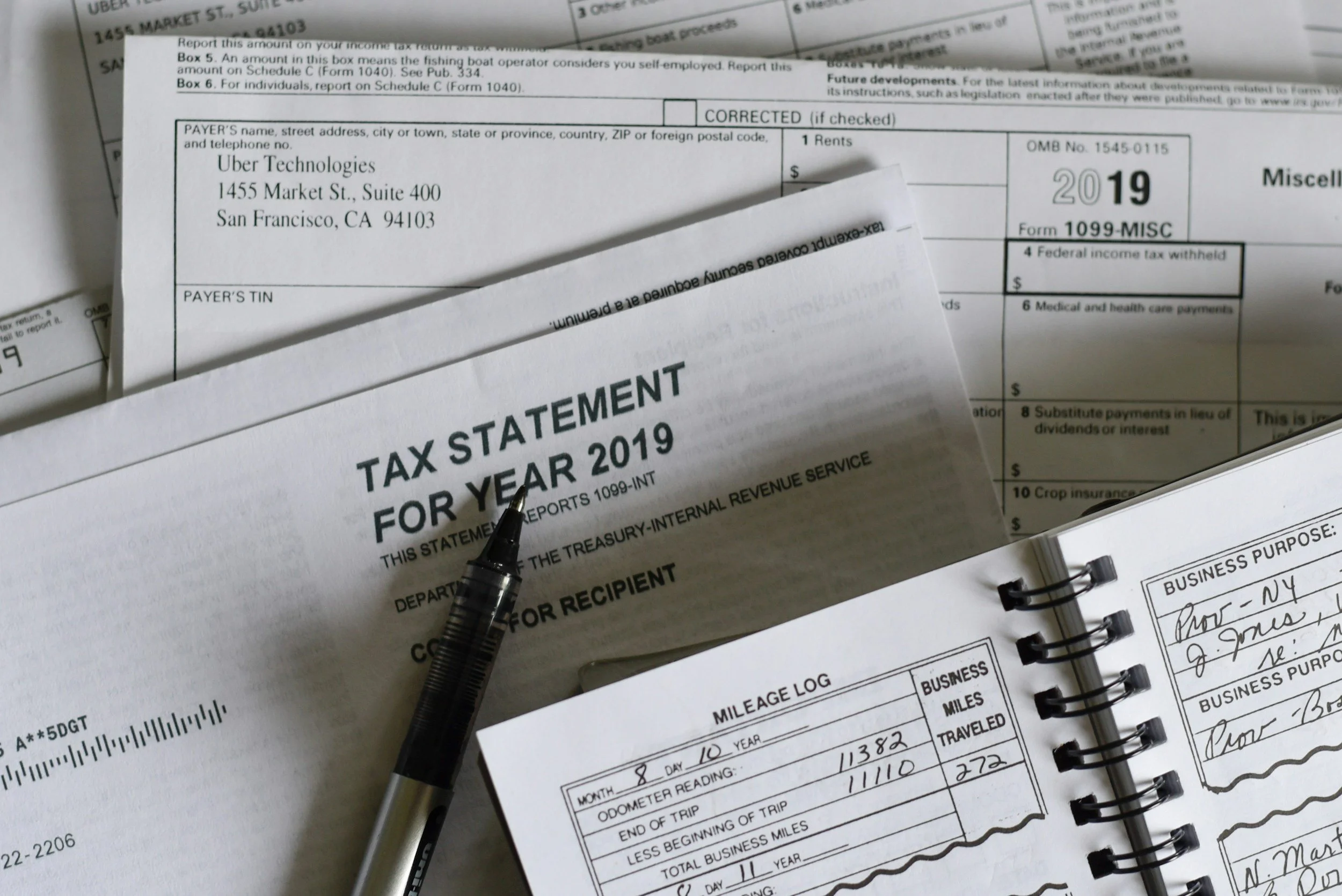

If a spouse forges the other spouse’s signature on a tax return, can the spouse whose signature is forged avoid liability for back taxes owed on the forged return? This was an issue in the case Deasy v. Deasy, 4D2023-0317 (Fla. 4th DCA May 15, 2024).

In this divorce case, the parties were found to owe back taxes on jointly-filed federal income tax returns. The former wife alleged the former husband forged her name on the tax returns without her knowledge or consent. She therefore argued that the former husband should be responsible for the tax debt. She relied on Fla. Stat. 61.075 which states “‘[a]ny liability incurred by forgery or unauthorized signature of one spouse signing the name of the other spouse” is the nonmarital liability of the party having committed the forgery or affixed the unauthorized signature, unless the forged or unauthorized signature was subsequently ratified by the other spouse. § 61.075(6)(b)5., Fla. Stat. (2019).” The trial court declined to make the former husband fully responsible for the tax debt. The former wife appealed this issue, among other issues.

The appellate court affirmed the trial court’s ruling, holding “Here, the tax deficiency was not a ‘liability incurred by forgery or unauthorized signature.’ The back taxes are not analogous to a loan obtained by forgery. A tax return is merely a representation to the federal government of the taxpayers’ income for a particular year. None of the parties’ tax debt was incurred because the husband signed the wife’s name to the tax returns without her authorization. Instead, the parties’ tax liability was incurred by virtue of their failure to pay sufficient tax on the income they earned from 2016 to 2018.”

Also notable in this case was the former wife’s appeal of the trial court’s denial of her request to hold the former husband responsible for marital waste of an asset. The appellate court reversed, holding “The husband’s sale of the Mercedes Sprinter Van for $1,000 should have been treated as marital waste. The evidence was that the fair market value of the van was about $30,200. The only reasonable interpretation of the evidence is that the husband intentionally sold this asset at far below market value to benefit a friend’s roommate at the expense of the marital estate.”

Schedule your meeting with a Miami family law attorney to understand your possible rights and remedies in your case.